For much of the past decade, global investors poured money into large, liquid markets — the U.S., Europe, and major emerging economies like China and India. Frontier markets, by contrast, were treated as too risky, too volatile, or too small to matter.

But in 2025, that narrative is shifting again.

With developed markets facing slower growth, high valuations, and fading monetary tailwinds, institutional and retail investors alike are rediscovering frontier markets — the smaller, younger economies offering high growth potential, favorable demographics, and increasing economic stability.

From Vietnam to Kenya, frontier-market assets are attracting capital inflows not seen since the early 2010s.

So the big question becomes:

Why are global investors coming back — and is the opportunity real this time?

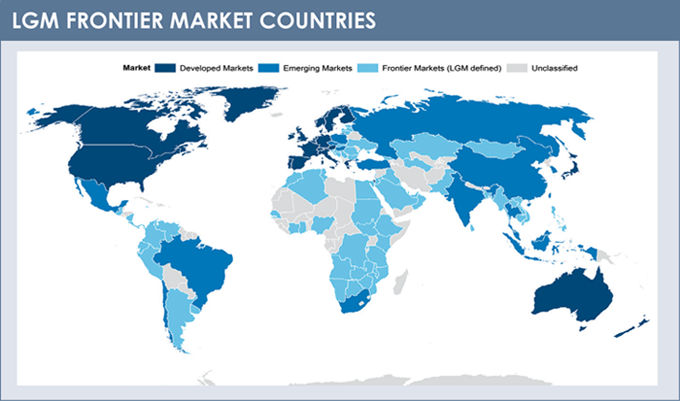

What Exactly Are Frontier Markets?

Frontier markets sit one step below emerging markets in terms of size, liquidity, and development. They typically feature:

- Expanding, youthful populations

- Early-stage financial market infrastructure

- High-growth potential but low investor participation

- Rapid urbanization and industrialization

- Currency volatility and political risk (but declining over time)

Examples include:

Vietnam, Kazakhstan, Nigeria, Morocco, Romania, Kenya, Sri Lanka, Bangladesh, and parts of Eastern Europe and Southeast Asia.

These countries often grow faster than established emerging markets — but with fewer investors and lower correlations to global cycles.

Why 2025 Became the Turning Point

Several global trends converged in the last 18 months to reignite interest in frontier markets:

1. The Search for Growth in a Slowing World

Developed markets are facing:

- Sluggish GDP outlooks

- Stretched equity valuations

- Slowing consumer demand

- High corporate debt

Meanwhile, frontier markets benefit from:

- Expanding middle classes

- High fertility rates

- Growing technology adoption

- Rising domestic consumption

Investors frustrated with Western stagnation see frontier markets as the new growth frontier — similar to how emerging markets looked in the 2000s.

2. Valuations Have Become Too Attractive to Ignore

After years of underperformance, many frontier-market equities trade at deep discounts:

- Price-to-earnings ratios often below 10

- Dividend yields higher than emerging markets

- Cheaper currencies after extended depreciation cycles

For value-oriented investors, frontier markets represent one of the last major pools of undervalued assets globally.

3. De-Globalization Has Created New Supply Chains

Companies looking to diversify supply chains away from China — a trend accelerated by geopolitics — are investing heavily in frontier economies.

Countries like Vietnam, Bangladesh, and Morocco are becoming manufacturing hubs for:

- Electronics

- Textiles

- Auto parts

- Renewable energy components

Foreign direct investment (FDI) inflows have surged, improving long-term stability and attractiveness for investors.

4. Commodity Supercycle Tailwinds

Frontier markets rich in natural resources — such as Nigeria, Kazakhstan, and Mongolia — are benefiting from rising global demand for:

- Rare earths

- Energy

- Agricultural commodities

- Industrial metals

- Critical minerals for EVs and solar panels

As nations compete for resource security, frontier markets gain leverage and investment.

5. Improved Political and Financial Stability

Many frontier markets have made meaningful progress in:

- Reducing inflation

- Strengthening central bank independence

- Reforming fiscal policies

- Increasing transparency

- Upgrading banking systems

While still risky, they are far more stable than they were ten years ago.

“Frontier markets are no longer the wild west,” says Helen Draven, emerging markets strategist at Titan Global. “They’re becoming the backbone of global diversification in the 2020s.”

6. The Rise of Frontier ETFs and Easier Access

Investing in frontier markets used to require:

- Specialized brokers

- High transaction fees

- Exposure to illiquid, expensive instruments

But now, frontier-market ETFs and index-tracking products give investors clean, diversified access with low fees and high liquidity.

This democratization of access is accelerating inflows.

What Makes Frontier Markets Appealing Right Now

Frontier markets combine three elements rarely found together:

✔ High growth potential

Many frontier markets grow at 5–7% annually, outpacing major emerging markets.

✔ Low correlation with global indexes

They don’t move in sync with the S&P 500 or European markets — ideal for diversification.

✔ Attractive demographics

Young populations drive consumption, entrepreneurship, and long-term economic dynamism.

This creates a compelling narrative:

low correlation + high growth + low valuations = powerful long-term opportunity.

But the Risks Are Still Real

Investors shouldn’t romanticize frontier markets — they remain high-risk environments.

⚠️ 1. Political instability

Elections, coups, and regime shifts happen more frequently.

⚠️ 2. Currency volatility

Exchange-rate swings can wipe out returns quickly.

⚠️ 3. Low liquidity

Markets can freeze during selloffs, making exits difficult.

⚠️ 4. Corporate governance issues

Accounting standards and transparency still lag developed economies.

⚠️ 5. Legal and regulatory uncertainty

Property rights and business laws can change with limited warning.

Frontier markets offer high reward — but also high volatility and long time horizons.

Are Frontier Markets the Next Big Rotation Story?

Many analysts believe that 2026–2030 could mirror the EM boom of the 2000s, when investors shifted en masse into high-growth developing economies.

The key drivers of such a move include:

- Lower global interest rates

- Increased FDI into Asia and Africa

- Tech adoption in emerging countries

- Infrastructure development

- Rising commodity demand

- Demographic advantage

If global conditions align, frontier markets could be the strongest performing asset class of the late 2020s.

How Investors Are Positioning Today

Institutional investors are building exposure through:

- Frontier market ETFs

- Local-currency government bonds

- High-yield frontier debt

- Infrastructure funds

- Private equity in manufacturing hubs

Retail investors are entering the space as well, although more cautiously.

Conclusion: A Return to the Edges of Global Growth

Frontier markets aren’t an easy bet.

They’re volatile, unpredictable, and often misunderstood. But in a world where traditional markets struggle to deliver high returns, frontier economies offer something rare: genuine growth potential.

For investors willing to stomach the risk and think long-term, frontier markets could become one of the most important investment stories of the next decade — a reminder that sometimes the best opportunities lie far from the spotlight.

The move back into frontier markets isn’t a fad.

It’s a signal that global capital is searching — once again — for the next frontier.

Related Posts

“Are Multi-Asset ETFs the Ultimate Portfolio Hedge for 2026?”

“Gold vs. Tech Stocks: Where Smart Money Is Moving in 2025”